The housing crisis in Ireland has become a prominent social issue, with a significant focus on the increasing number of young adults living with their parents. This phenomenon has been highlighted by recent statistics from the Central Statistics Office (CSO), which sheds light on the experiences of both young adults and their parents in this living arrangement.

Increasing Trend of Young Adults Living at Home

According to Census 2022, over 440,000 young adults were living with their parents, marking a 13% increase from Census 2016. This figure represents 41% of individuals aged between 18 and 34, up from 37% in 2016 and 32% in 2011. The data indicates a growing trend of young adults staying at home longer, influenced by various socio-economic factors.

Age and Regional Variations

The likelihood of living with parents decreases with age. In 2022, the age at which more than half of young adults moved out was 24, compared to 23 in 2011. Notably, one in five (20%) individuals aged 30 were still living with their parents in 2022, up from 13% in 2011. Regionally, Galway City had the lowest proportion of young adults living with parents, while South Dublin had the highest.

Financial Considerations

The CSO’s Pulse survey “Life at Home 2021” offers valuable insights into why young adults live with their parents. Financial reasons are a significant factor, with 62% of those in full-time employment citing finances as the primary reason for staying at home. An additional 22% mentioned finances played a partial role, while only 16% said finances were not a factor.

Parental Perspectives

The survey also explored the perspectives of parents and their adult children. Interestingly, 57% of young adults living with parents reported enjoying the arrangement, whereas 87% of parents enjoyed having their adult children at home. However, 88% of young adults expressed a desire to move out, compared to 50% of parents who preferred their children to move out.

Independence and Household Dynamics

A significant portion of young adults felt their independence was compromised. Over half (52%) believed their parents would not treat them as adults unless they moved out. Additionally, 70% felt they lacked independence in social activities and meal choices.

Financial Contributions and Disagreements

Regarding household expenses, 83% of young adults in full-time employment contributed to household costs, compared to 64% of those in part-time employment and 29% of students. Common sources of disagreement included household chores, the use of shared facilities, and noise. Notably, 60% of young adults reported frequent disagreements about chores, with mothers’ opinions prevailing more often than fathers’ in household disputes.

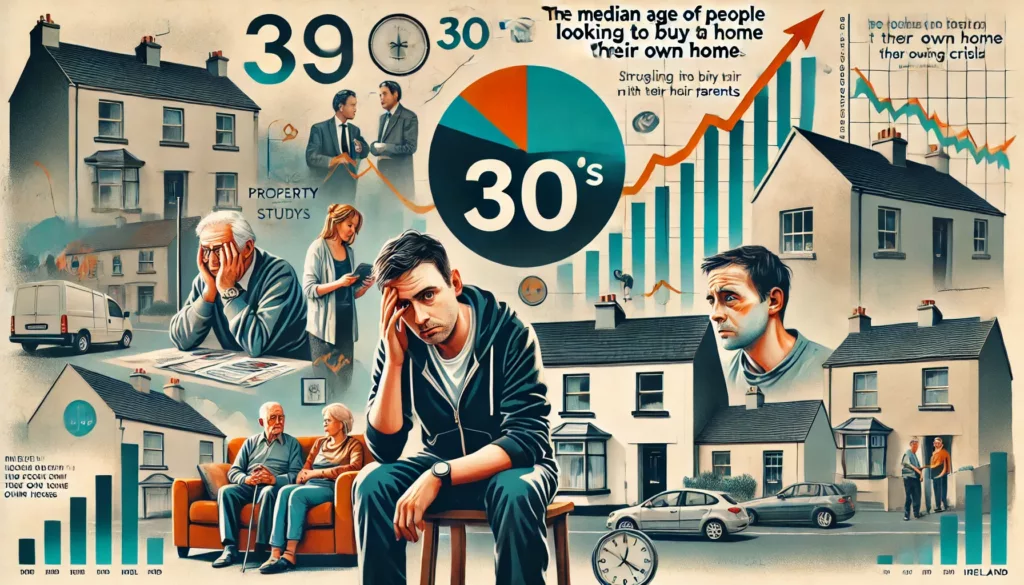

Profile of House Buyers

The CSO data also provides insights into the profile of house buyers. The median age of residential property buyers increased from 35 to 39 years between 2010 and 2021. For those purchasing with a mortgage, the median age rose from 33 to 37 years. First-time buyers accounted for 54% of purchases in 2010, but this dropped to 35% in 2023. The median price paid by buyers with a mortgage was €309,000 in 2021, with a median loan amount of €220,000, compared to €247,000 and €191,000 respectively in 2010.

Inheritance and Homeownership

The 2020 Household Finance and Consumption Survey revealed that homeowners are more than twice as likely as renters to have received an inheritance or substantial gift, with 44% of homeowners and 18% of renters reporting such financial support. The median value of these gifts or inheritances was significantly higher for homeowners (€98,300) compared to renters (€15,200).

The CSO continues to publish extensive data on housing, offering valuable insights into the ongoing housing crisis and its impact on young adults and their families. For more detailed information, the CSO’s data can be accessed online and through various social media channels.